Charlottesville, Virginia – In its new study, “Opportunities for Additive Manufacturing in Commercial and General Aviation,” SmarTech Markets Publishing projects revenues from additive manufacturing (AM) hardware, software, materials and services for commercial and general aviation to reach around $1.7 billion in 2020, rising to $3.3 billion in 2022.

This report explores the opportunities in the AM supply chain in non-defense aerospace markets. It contains 10-year forecasts including: revenue forecasts with breakouts by software, services, hardware and materials; number of parts printed for each application, with breakouts by prototypes, tooling, and final use components; and the install base of printers.

Leading players from discussed in this report include: 3D Systems, Addaero Manufacturing, Airbus, Air Transit, Alcoa, AP&C, Arcam, Avio, BAE Systems, Boeing, Concept Laser, Constellium, DM3D, EADS, EnvisionTEC, EOS, ExOne, Fabrisonic, Farsoon, GE Aerospace, GKN Aerospace, Honeywell, HP, Kelly Manufacturing, Materialise, Matsuura, Mitsubishi, MTU Aero Engines, Northrop Grumman, Optomec, Oxford Performance Materials, Pratt & Whitney, Renishaw, Rolls-Royce, Sciaky, Sintavia, SLM Solutions, Stelia Aerospace, Stratasys, and Turbomeca

Highlights from the report:

- Within the past five years, the aerospace industry has invested heavily to explore the possibilities for AM technology to produce aircraft components in a more cost effective manner, or fabricate advanced components not feasible through traditional manufacturing methods.

- Revenues from AM hardware for non-defense aerospace markets will reach $650 million in 2020, with about half these revenues coming from powder bed fusion. Powder bed firms are expected to build machines with larger print bed sizes to push into new aerospace applications. Meanwhile, the short-term outlook for metal powder bed in commercial aerospace is largely positive thanks to commitment from aerospace engine suppliers to manufacture select components beginning in late 2015.

- Revenues from AM materials sold to the non-defense aerospace sector are expected to reach $355 million in 2020, with $170 million from metals. From a revenue standpoint, titanium remains the biggest opportunity. However, many firms are working to expand opportunities in nickel alloys, cobalt chrome, and aluminum alloys. Meanwhile, several large general aviation manufacturers have transitioned select polymer parts to production with 3D printing rather than traditional methods.

- The non-defense aerospace sector is expected to spend $700 million on AM services in 2020. However, there are some concerns in the AM service provider community that that print volumes from aerospace customers may eventually erode as manufacturing operations moves in house. SmarTech envisions a sizeable opportunity for 3D printing service providers to specialize in aircraft manufacturing and move in to support an increasingly pressured aerospace supply chain.

Last month SmarTech published a companion covering AM in space and defense.

Source: SmarTech Markets Publishing

(Boeing photo)

Get curated news on YOUR industry.

Enter your email to receive our newsletters.Loading...

Latest from Aerospace Manufacturing and Design

- Qatar Airways orders up to 210 Boeing widebody jets

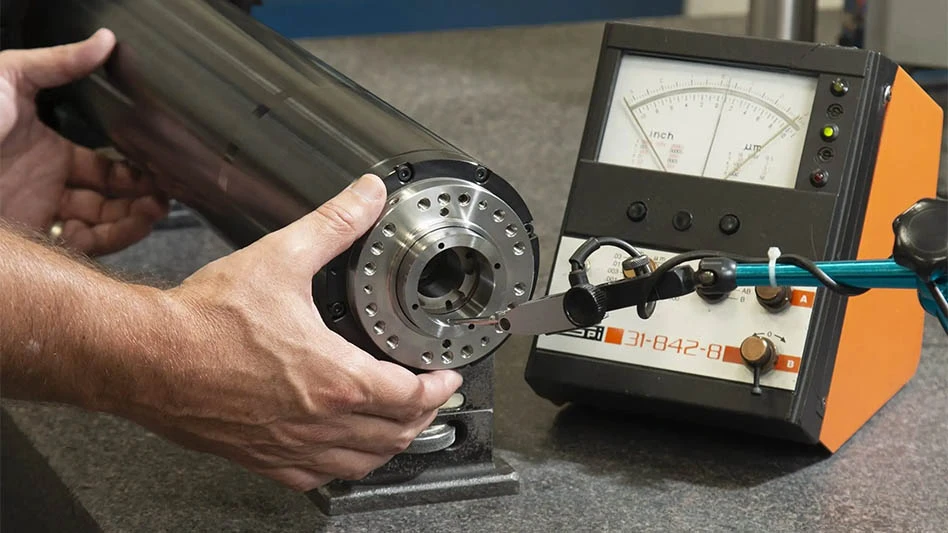

- Digital test indicator offers larger measuring ranges

- AviLease orders up to 30 Boeing 737 MAX jets

- 256-piece general maintenance tool kit

- JetZero all-wing airplane demonstrator achieves milestones

- Cermet indexable inserts for medium turning operations

- Trelleborg acquires Aero-Plastics

- Industrial automation products, enclosed encoders