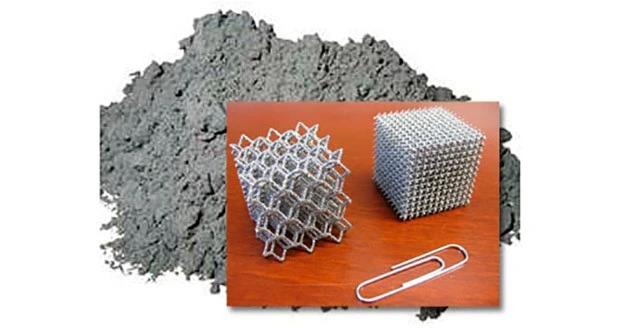

London – New applications in the medical, aerospace, oil & gas, and dental sectors will increase demand for powered materials exponentially. In this regard, SmarTech analysts believe that GE's recent $50 million dollar investment in its Auburn, Alabama, plant to additively manufacture LEAP engine fuel nozzles is a prelude to larger investments in metal powder AM equipment by many large manufacturers that will soon require powdered materials for 'round the clock production.

Meanwhile, new powdered metals open up new applications that will cause metal powder application database to multiply during the next 7 years. Forward-looking metal powder manufacturers such as Sandvick Osprey, Carpenter Powders, and AP&C are already beginning to move up the AM learning curve, working with equipment OEMs to create higher performance, more consistent powders.

In this report, SmarTech analysts provide in depth coverage and market analysis of metal powders for AM manufacturing market. The report includes the most complete and accurate market forecasts for metal powder materials in the AM industry. In this report, market numbers for metal AM powders are reported both in terms of total material weight, as well as total market size. Opportunities are broken down by application, powder type, and OEM equipment manufacturer.

Among the areas discussed in this report are the following:

- Emerging strategies of the metal powder industry for improving powder consistency, performance, and costs: Based on interviews with industry leaders, SmarTech analysts examine the methods that the metal powder industry uses to differentiate their products, as well as drive production efficiencies in metal AM powders.

- End-user requirements for new metal powders: The list of available powders for AM is still quite limited. This bottleneck restricts some of the highest value opportunities for AM, particularly in the aerospace industry. SmarTech analysts provide in-depth coverage of end-users who are pushing the boundaries of AM applications and determine the best direction for future metal powder development. Atomized metal powders for AM must meet drastically different specs than powders for other applications.

- Supply chain capacity analysis: In this report, analysis provides critical assessments for the metal AM powder producers, OEM manufacturers, and major powder end-users.

By looking at both current supply chains and major distribution channels, SmarTech analysts help clients determine when and where the largest opportunities lie, as well as where the incumbents' blind spots are.

Analysis of the role of OEMs in metal powder demand: Large production AM machine OEMs are working to secure their control of metal powders that run on their machines. SmarTech analyzes how these moves are likely to impact the make-up of the industry during the next 10 years.

Source: ReportBuyer

Latest from Aerospace Manufacturing and Design

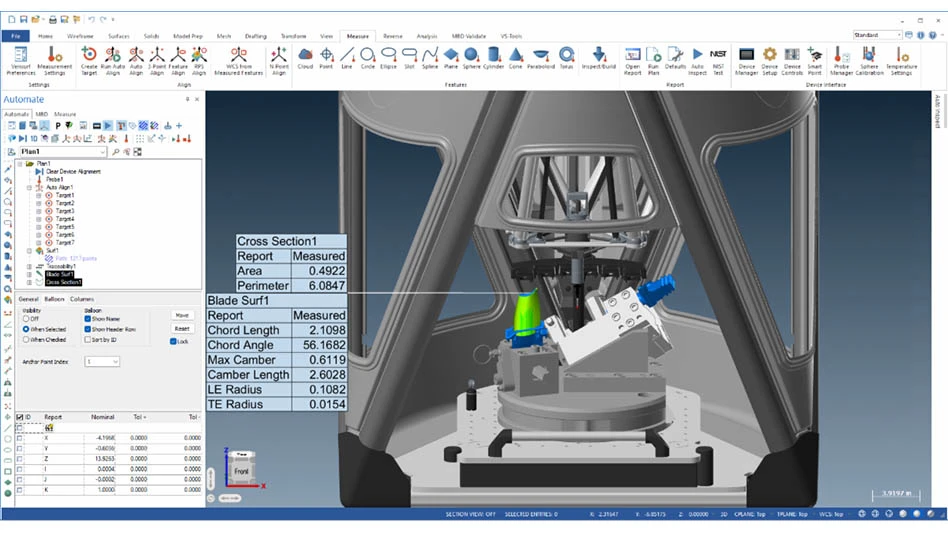

- Simplify your shop floor operations while ensuring quality parts

- Happy Independence Day - July 4th

- Bombardier receives firm order for 50 Challenger, Global jets

- Automatic miter bandsaw

- SAS orders 45 Embraer E2 jets with options for 10 more

- Height measuring instrument

- Shopfloor Connectivity Roundtable with Renishaw & SMW Autoblok

- Moog expands space actuation, avionics manufacturing