Global manufacturers are putting their supply chains at the center of their business strategies to serve as the foundation for operational efficiency and collaborative innovation, according to KPMG's 4th annual Global Manufacturing Outlook – Competitive Advantage – Enhancing Supply Chain Networks for Efficiency and Innovation, which surveyed 335 C-level executives globally – including 95 in the U.S.

Ironically though, many manufacturing executives (49% globally; 54% U.S.) admit that their companies currently do not have visibility of their supply chain beyond Tier 1 suppliers. Moreover, only 9% of the 335 global respondents of the 2013 KPMG 2013 survey say they have complete visibility of their supply chains. That number is even lower among U.S. executives, with only 7% claiming complete supplier visibility.

"Obtaining real-time visibility across all tiers in the supply chain can significantly increase speed to market, reduce capital expenditures and manage risk," says Jeff Dobbs, global sector chair, diversified industrials and a partner with KPMG in the U.S. "Moving toward a demand-driven supply chain is probably the single most important step a global manufacturer can take today."

However, this could prove challenging, as Dobbs points out that "much of the supply chain technology is outdated."

In fact 44% of respondents overall say they still use email, fax and mail as the means to communicate issues about demand in the supply chain.

"The winners will be the ones who can network real-time across their entire supply chains, reducing the information lag that costs companies significant time and money," Dobbs adds.

When asked about their ability to assess the impact of an unplanned supply chain disruption, a similarly small percentage of executives, (9% global; 7% U.S.) say they are able to assess the impact within hours. However, the most frequent response among global executives was one and six days (36%) and U.S. respondents most frequently said one to two weeks (32%).

To help manage supply chain risk and continuity in the event of unanticipated disruptions, executives (58% globally; 71% U.S.) say they plan to regionalize or localize their supply chains.

Overall, China and the U.S. remain the top sourcing locations, but the report shows that many will keep sourcing closer to their major markets over the next 2 years. Nearly 90% of U.S. respondents will increase sourcing in the U.S. followed by Canada (18%) and China tied with the U.K. at 13%.

Focus on Growth and Innovation

On the growth front, a third of all companies globally and in the U.S., and 47% of larger companies (over US$5 billion in revenue), are looking to pursue mergers and acquisitions over the next two years. In the U.S. specifically, executives indicate that the priority transactions for their companies will be investing in Greenfield opportunities in growth markets, M&A and innovation driven by enhanced collaboration in the supply network seen as growth drivers.

Manufacturers maintain that investment in R&D is essential for growth: 38% of U.S. respondents expect to invest 4% or more of revenue in R&D and innovation over the next 24 months, which is 20%age points higher than the level being invested currently, according to the findings. Seventy-one percent of U.S. respondents say their R&D will largely be incremental, with a focus on enhancing existing products and lines, 29% plan to invest in breakthrough innovation – comparable to overall global results.

"As companies step up investment in innovation, whether in search of breakthrough R&D or incremental improvements, they are increasingly looking to their supply network for ideas," Dobbs comments.

Innovation Borne Out of the Supply 'Network'

Just over half of global respondents (51%) say that partnerships with suppliers will define the direction of innovation, and over the next two years, 57% expect at least 10% of their revenues to come from innovations. Yet paradoxically, the biggest challenges manufacturers say they have with regard to innovation is aligning it to the business strategy (34%), and the complexity in collaborating with suppliers and partners (32%).

"Supply chain partners will play a critical a role in a manufacturer's innovation strategy as part of their investment in R&D," Dobbs adds. "Mitigating the challenges of collaborating with partners is complex; close familiarity with who your suppliers are and how they operate will certainly help optimize performance."

KPMG's Dobbs believes notable shifts in the way companies are redefining and investing is indicative that manufacturing is on the verge of a "hyper-innovation era. The sector may appear to be slowly evolving, but it is on the cusp of explosive change in the next three to five years. The prolonged stage of intense competition, modest growth and a hyper-focus on cost reduction has strongly positioned companies to maximize this next phase of innovation. With new data technologies proliferating to enhance partnering, shared efficiencies, and visibility, we will start seeing some breakthrough and disruptive innovation in manufacturing – not only to the products but also to the process."

About the Report

KPMG's 2013 Global Manufacturing Outlook, a report from the Economist Intelligence Unit, is based on a survey of 335 senior executives, conducted in November 2012. Executives represented five industries:

Aerospace and Defense, Automotive, Conglomerates, Engineering and Industrial Products, and Metals. Forty-six percent were C-level, including board members. Respondents came from companies of many different sizes: nearly 30% represent companies with more than US$5bn in annual revenue. Respondents are distributed globally, with nearly a third each from The Americas; Asia; and Europe, the Middle East, and Africa.

Latest from Aerospace Manufacturing and Design

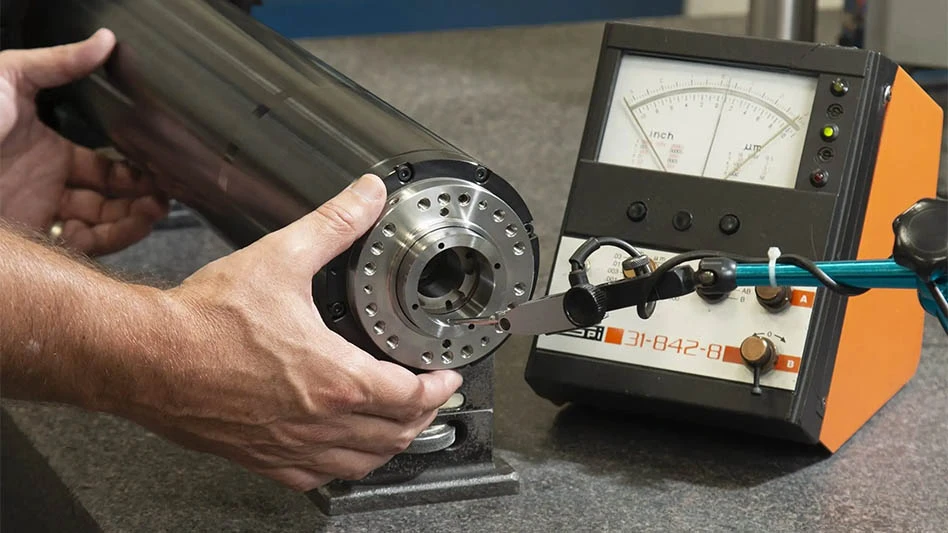

- Digital test indicator offers larger measuring ranges

- AviLease orders up to 30 Boeing 737 MAX jets

- 256-piece general maintenance tool kit

- JetZero all-wing airplane demonstrator achieves milestones

- Cermet indexable inserts for medium turning operations

- Trelleborg acquires Aero-Plastics

- Industrial automation products, enclosed encoders

- #61 - Manufacturing Matters: CMMC roll out: When do I need to comply?