It’s no secret that Baby Boomers are moving into their retirement years. What is yet to be revealed, however, is how heavily their absence is going to impact aerospace manufacturing output.

The coming changes in size and composition of the U.S. aerospace workforce mirrors the unprecedented shift in labor demographics affecting both the United States and, to varying degrees, industrialized nations around the world. Starting in the middle of the Twentieth Century, the U.S. experienced a consistent period of growth in both population and the number of skilled workers. According to the U.S. Census Bureau, the U.S. labor force grew from 62 million in 1950 to 149 million in 2005. The 1960s were the high point of this surge, as new workers entered the labor ranks at a rate of 1.7% annually.

Soon, however, things began to change as the Baby Boomer generation completed its entry into America’s offices and factories. Annual growth in the national labor force slowed to 1.6% annually in the 1980s, and to 1.1% in the 1990s. More troubling, experts predict that the next 50 years will bring a virtual standstill to the skilled workforce. The journal Monthly Labor Review reported in 2002 that the supply of available workers is projected to grow only at a rate of 0.6% annually between 2000 and 2050, as Baby Boomers retire and fewer adults enter their working years.

This exit of experienced manufacturing personnel comes at a time when the U.S. aerospace industry is seeing renewed demand and record backlogs, especially from the commercial segment. In its 2010 Year-End Review and Forecast, the Aerospace Industries Association predicted a new high in industrywide sales for 2011 of nearly $220 billion. The Congressional Research Service, an arm of the Library of Congress, estimates that airlines will require 29,000 new planes, comprising a combined value of $3.2 trillion, between 2009 and 2028.

What do today’s aerospace executives expect from these megatrends? To find out, Advanced Technology Services, Inc. (ATS), a major U.S. manufacturing services outsourcer, commissioned a survey of aerospace manufacturers earlier this year. The results, coming from 141 companies ranging in revenue of $100 million to over $1 billion, paints a picture of both concern and opportunity.

Clearly the skilled labor shortage is beginning to take its toll. Sixty-three percent of those managers surveyed said the lack of well-trained employees was holding back their company’s ability to grow, either slightly, moderately or extremely. Moreover, the cost of the looming crisis is expected to be high. Overall, the growth in retirees is expected to cost all manufacturers surveyed an average of $30 million each over the next five years - even more for manufacturers with revenues over $1 billion, who predict $100 million in additional costs annually.

Adding to the situation is a shortage of production capacity. The entire aerospace industry is feeling the frustration; today only one third of those manufacturers surveyed feel they have enough capacity to meet their manufacturing demand for the next 2 to 3 years. Only 1 in 10 is confident in their company’s ability to meet customer demand over the next 3 to 5 years.

Confirming broader trends, commercial customers are expected to be the greatest source of business over the next 10 years. According to the ATS study, 60% of respondents said industry sales will come primarily from the private sector, as the world’s airlines replace their aging fleets. Only 10% felt the bulk of their demand would come from the military, thanks to cuts in defense budgets and government spending. Thirty percent said business would be strong from both segments.

With these huge concerns over manufacturing capacity and the ability to recruit and train workers with the necessary skills, outsourcing key tasks would seem to be a solution. Perhaps surprisingly, the concept of outsourcing to foreign countries was not favorably received. Most (74%) surveyed did not believe foreign manufacturers have the necessary technical skills and quality systems in place for the exacting demands of the aerospace industry.

When rated on the most preferred countries for outsourcing, China came in dead last, with 60% giving Chinese the lowest probability rating. Brazil and India also received poor marks. While Mexico was the highest, it scored a scant 13% as a country well suited for aerospace support.

The concept of domestic outsourcing of certain tasks within the aerospace sector is gaining ground. When asked, “Since the economic downturn, are you likely to staff up for increased demand or outsource entire functions?” More than 50% of those with revenues of $1 billion or more said they would outsource entire functions, leaving the door open to domestic sources.

The ATS study also looked at which functions were most attractive outsourcing targets. Information Technology (IT), with a 42% positive rating, and facilities maintenance, at 38%, were the most likely to be contracted. Production maintenance (27%) and HR (19%) were also considered as possibilities.

Also an option is encouraging retirement-age workers to stay on the job longer. Research shows that many workers are open to working past age 65, at least part-time. Several factors are contributing to this situation, including better health for many Baby Boomers, changing attitudes about work, and - perhaps not surprisingly - downturns in the stock market that have decreased the value of individual 401k plans.

Job sharing and flextime are two options that are gaining ground in the aerospace field. So is partial-pension arrangements that allow workers to begin drawing on their retirement benefits while still working in a reduced role. Northrop Grumman, among others, are creating programs that allow more experienced workers to transfer their job skills to younger, less-experienced employees through coaching and mentoring.

In short, the changing character of the skilled workforce will present a major challenge to aerospace OEMs and their supply chains in the years ahead. Fewer trained job candidates and multi-year order backlogs are adding to the stress; so too is the nature of defense contracts that mandate U.S. citizenship for aerospace employees in order to receive security clearance. The growing need for qualified employees will require a multi-faceted response of competitive wages and benefits for new workers, strong mentoring and job training programs, strategic outsourcing, and worker retention efforts in the years and decades ahead.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.Latest from Aerospace Manufacturing and Design

- Qatar Airways orders up to 210 Boeing widebody jets

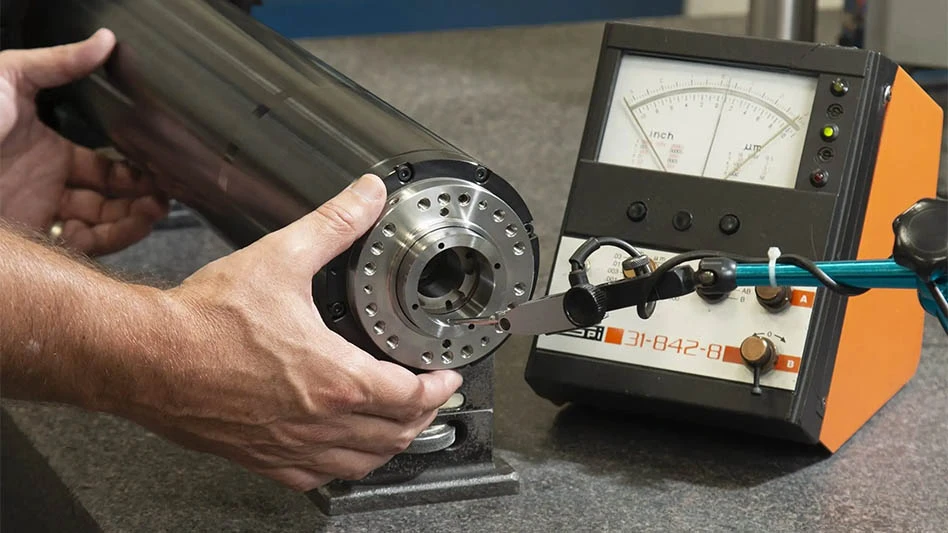

- Digital test indicator offers larger measuring ranges

- AviLease orders up to 30 Boeing 737 MAX jets

- 256-piece general maintenance tool kit

- JetZero all-wing airplane demonstrator achieves milestones

- Cermet indexable inserts for medium turning operations

- Trelleborg acquires Aero-Plastics

- Industrial automation products, enclosed encoders