New York / London / Renton, Washington – Liberty Hall Capital Partners, a private equity firm focused exclusively on investments in businesses serving the global aerospace and defense industry, has acquired AIM Aerospace, an independent supplier of composite ducting, substructural and interiors parts for the commercial aerospace industry. AIM Aerospace will serve as the foundational asset of Liberty Hall’s newly launched strategy to build a fully- integrated, diversified composites supplier through organic investments and strategic acquisitions. Liberty Hall’s investment partners in the transaction include funds managed by BlackRock Private Equity Partners, Northwestern Mutual Capital and other leading institutional investors.

“The commercial aerospace market continues to enjoy strong, long-term secular growth, driven by demand for next generation aircraft,” said Rowan Taylor, Liberty Hall’s founding partner. “With this unprecedented growth in aircraft deliveries, aircraft manufacturers are increasingly transitioning from metallic to composite materials that provide weight savings and other beneficial properties that increase fuel efficiency and durability. As a private equity firm focused exclusively on the aerospace and defense industry, we see significant opportunities in this segment of the industry and believe that AIM Aerospace possesses an ideal combination of capabilities, customer relationships and a proven track record of success. The growing demand for composites provides an opportunity for AIM to serve as the platform investment for Liberty Hall to build a fully-integrated, diversified composites supplier.”

Founded in 1988 as part of the UK-based AIM Group PLC, Renton-based AIM Aerospace supplies composite parts for Boeing platforms, including the 737, 777 and 787. It is one of the largest employers in the greater Seattle area with more than 1,000 employees operating from facilities located in Renton, Auburn, and Sumner, Washington. The company’s largest customers include The Boeing Co., Kawasaki Heavy Industries, Spirit AeroSystems and B/E Aerospace. AIM Aerospace was a 2014 recipient of the Spirit Supplier of the Year Award.

AIM’s existing management team, led by John Feutz, President, will remain in their roles following the acquisition. “Liberty Hall provides a unique combination of relationships, experiences and resources that will allow us to grow AIM Aerospace and better serve our existing and new customers,” Feutz commented. “We are very excited to partner with Liberty Hall as we continue to set the industry standard for customer solutions and prepare for further growth of our business.”

AIM Aerospace represents Liberty Hall’s second platform acquisition. Liberty Hall previously formed Accurus Aerospace Corp., a fully-integrated, highly diversified Tier II aerostructures supplier, in 2013. Since its formation, Accurus has completed three strategic acquisitions: Precise Machining & Manufacturing (2013), McCann Aerospace Machining (2014) and LaCroix Industries (2015).

Since 2000, Liberty Hall’s principals have invested $2.2 billion in equity capital in ten platforms and eight add-on acquisitions serving the aerospace and defense industry and complementary industrial end markets. First lien financing for the acquisition was arranged by Antares Capital, Citizens Bank and KeyBanc Capital Markets Inc. and second lien financing was arranged by Carlyle GMS Finance, Inc. Legal advice to Liberty Hall was provided by Schulte Roth & Zabel, Ashurst and Pillsbury. AIM Group was advised by Lincoln International, Stephenson Harwood and Riddell Williams.

Source: AIM Aerospace

Latest from Aerospace Manufacturing and Design

- Qatar Airways orders up to 210 Boeing widebody jets

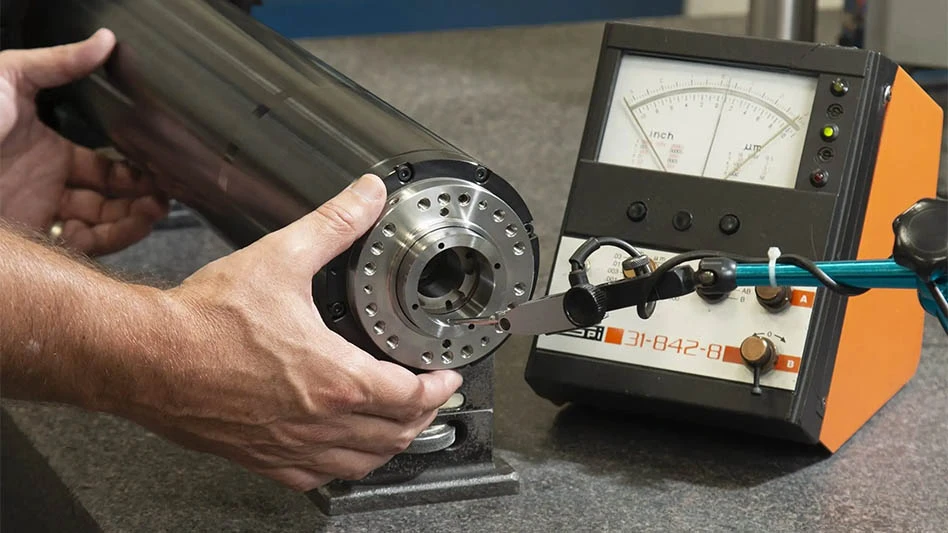

- Digital test indicator offers larger measuring ranges

- AviLease orders up to 30 Boeing 737 MAX jets

- 256-piece general maintenance tool kit

- JetZero all-wing airplane demonstrator achieves milestones

- Cermet indexable inserts for medium turning operations

- Trelleborg acquires Aero-Plastics

- Industrial automation products, enclosed encoders