NASA

The Apollo program remains one of the great technological accomplishments of humankind, but it didn’t accelerate space commerce the way its visionary leaders intended. We haven’t been back to the moon since 1972. We don’t have a human settlement on Mars. We don’t have an American spacecraft to take our astronauts to and from space. One could be disappointed, but things are changing rapidly.

Energizing many are the thrilling successes of SpaceX and other privately funded ventures, and private markets are now paying attention to lower-cost missions enabled by small satellites. This is shining a light on current space capabilities and NASA is taking advantage of this newfound attention.

Accelerating space commerce

Half a century after Apollo, NASA is taking a different approach to accelerate space commerce, exploration, and discovery. Rather than traditional cost-plus contracts, NASA is acting more like a customer buying a service. By using its existing Other Transaction Authority – typically Space Act Agreements or other Public-Private Partnerships – NASA is providing seed funding and asking industry to invest in an off-world future. With industry sharing risk, we expect to have commercial sources for every leg of the transportation network from Earth to the moon by the late 2020s.

This fundamental shift could unleash a wave of new commercial capabilities, from in-space housing to taxis ferrying people and cargo to and from the moon and Mars. Manufacturers would be incentivized to move boldly if they know NASA and other government customers will buy the services they enable.

Tested approach

Government has done this in the past. The Air Mail Act of 1925 allowed the Postmaster General to contract with private companies to deliver mail. Companies that received the 12 contracts are credited with ultimately creating the modern airline industry. To establish an off-world future, we want multiple suppliers for each leg of the transportation network so there’s assured access and competition to drive costs down. We are headed in that direction.

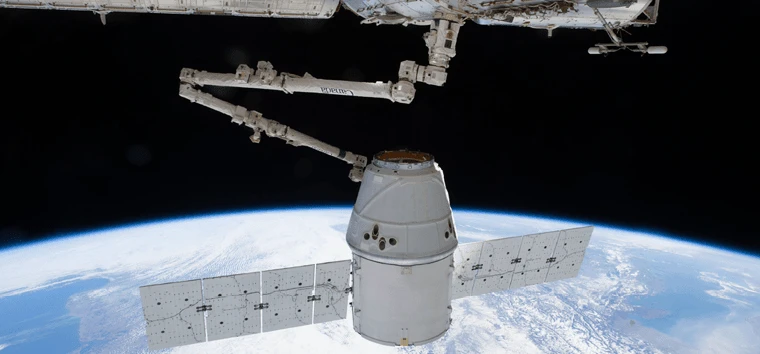

Starting in 2006, NASA’s Commercial Orbital Transportation Services (COTS), and its follow-on Commercial Resupply Services (CRS and CRS2) contracts, developed the cargo delivery services that support the International Space Station (ISS). COTS funded the development of the SpaceX Dragon and Northrop Grumman Cygnus systems. CRS and CRS2 were awarded in 2008 and 2015 for delivery services, adding Sierra Nevada’s Dream Chaser as a third service supplier. Compared to NASA’s traditional procurement approach, these contracts gave industry broad leeway in how to design systems, only controlling those parts that interacted with the ISS. To date, 29 cargo delivery flights to the ISS have been made under this program.

The Commercial Crew program is poised to deliver astronauts to space in 2020 on U.S.-made spacecraft for the first time since 2011. Boeing’s CST-100 Starliner and SpaceX’s Dragon are being prepared for their first missions. While developed under a more traditional procurement framework, the result is still a commercial product, giving government astronauts and private citizens the choice of flying on two different vehicles to and from space.

Building infrastructure

We have long envisioned a future where more people are living and working in space. They will conduct scientific research, manufacture goods for use in space or back on Earth, and occupy new platforms for adventure tourism. This time, we are going to the moon to stay, so we will need a range of support services, both human and robotic, and new infrastructure to support long-term settlement.

Artemis program:NASA is managing and soliciting a broad network of partners for transportation services from the Earth to the moon. Several different procurements are active, with each using a slightly modified version of the approach used to procure ISS cargo delivery services.

Commercial Lunar Payload Services (CLPS) program: Valued at $2.6 billion throughout 10 years, CLPS will deliver small- and medium-sized payloads to the lunar surface. Nine companies were announced in November 2018, with five companies added a year later. These 14 companies offer a catalog of options, with each able to bid on NASA-issued task orders. CLPS is moving fast, with lunar landing task orders already awarded to Astrobotic and Intuitive Machines. These missions will carry small payloads to the lunar surface in 2021. NASA intends to fly up to two CLPS missions per year.

Lunar Gateway: Currently in development, this small, human-tended space station will orbit the moon. The Orion spacecraft, launched on the Space Launch System (SLS), will bring astronauts to Gateway, the staging point for robotic and crewed exploration of the lunar surface. A future version of Gateway is envisioned as the staging point for NASA’s Deep Space Transport concept to travel to Mars. The Lunar Gateway will include the Power and Propulsion Element (PPE) developed by Maxar, and the Habitat and Logistics Outpost (HALO) module developed by Northrop Grumman. Contracts for these two elements were awarded in 2019.

Gateway Logistics vehicles: A new fleet will deliver payloads and other cargo to support missions to the lunar surface. Proposals were delivered in October 2019, and NASA is expected to award up to $7 billion in contracts, funding development and services throughout 15 years. These vehicles will deliver at least 3,400kg of pressurized cargo and 1,000kg of unpressurized cargo to the Gateway on each mission.

Human Landing System (HLS): A key element of Artemis will be transporting astronauts from the Gateway to the lunar surface. NASA plans to award contracts to two different teams to participate in the first phase of this multiyear effort. If this multiple-source approach continues through development, these landers will be available to support government and commercial missions to the moon in the mid-to-late 2020s.

Beyond the moon

Separately from Artemis, NASA is preparing to invest in the low Earth orbit (LEO) commercial ecosystem to develop commercial modules and free flyers. Combined with existing commercial launch companies such as SpaceX, ULA, Northrop Grumman, and RocketLab, there is growth potential in LEO space development.

Finally, we will need infrastructure in space to support our off-world future. The development of power; communications; positioning, navigation, and timing (PNT); habitation and manufacturing platforms; and civil infrastructure – roads and launch/landing pads – is essential. The leadership and foresight that led to the Transcontinental Railroad, the Interstate Highway System, and the Global Positioning System (GPS) will be needed to spur future commercial development in space.

These examples are incredibly capital intensive, so how does the current industrial base adjust and grow to support future growth in space?

After years of consolidation, the space industry is seeking new suppliers with commercial operations experience. NASA’s investments could create market surety, encouraging businesses to invest in new space technologies and applications. Solving the challenges of living and working in space – protecting humans from radiation, protecting components from lunar dust – requires the ingenuity of many.

Planetary exploration requires broader capabilities and knowledge than what’s available today. We’ll need expertise in telecommunications, agriculture, mining, and construction to build an off-world future. But these markets will take time to develop, so how will we encourage these non-endemic industries to come and invest for the longer term required in the space industry?

Great economic benefit comes from exploration. It has been governments’ responsibility to invest in the infrastructure needed to move the economy forward. NASA’s investments in transportation are laying the groundwork for a much larger space economy. This foundation, combined with the commercial launch services available and in development, has the potential to change how we live on Earth.

Explore the March 2020 Issue

Check out more from this issue and find your next story to read.

Latest from Aerospace Manufacturing and Design

- DEMGY Group acquires Tool-Gauge

- OES’ dual-axis yaw pitch stages

- Mastering high-temp alloys with Kennametal Inc.

- Boeing to sell portions of digital aviation solutions

- SMW-Autoblok’s KNCS-matic 3-jaw power chuck

- 3 Questions with an Expert with Allied Machine & Engineering

- Electra raises $115M to pioneer Ultra Short aircraft

- Walter’s WT26 partial- and full-profile thread turning inserts