Eric Brothers Eric BrothersSenior Editor ebrothers@gie.net |

Big, biennial air shows such as the one just held in Paris are great places to get a true sense of the industry. Beyond the flying displays, the marketing efforts, and major sales announcements from OEMs, these events offer the opportunity to touch base with aerospace companies from all levels of the supply chain. Unheralded but important news comes from informal chats with vendors in the exhibit halls, during meals, or while waiting in taxi lines. And the news is reassuring. Our publishing group sees many reports on the state of manufacturing, and the statistics for the first half of the year have indicated machine tool consumption is down, production is slowing, and there is growing cause for concern about the state of the economy. That’s what the numbers indicate, but what I discovered from many people at the Paris Air Show is that while the numbers may be correct overall, they are measuring averages across many industries. The consensus among many of the air show exhibitors is that declines in oil & gas production have dragged down manufacturing’s stats, but aerospace is still doing well. The averages look bad, they say, but those numbers don’t reflect the true state of our business sector. These manufacturers say they are busy – with work trending up or at least staying level. The principal aircraft producers continue to announce fantastically strong sales numbers – more than 900 commercial airliner orders or commitments at Paris for Airbus, Boeing, ATR, and Embraer – and each of those airplanes will require commensurate numbers of turbine engines, landing gear components, electronics suites, seating, and all the other parts the OEMs depend on their suppliers to produce. The backlog means years of business, even if some of the commitments never materialize. The real concern expressed by many of your peers at the exhibit hall stands was how were they going to keep up? If any aircraft production slow-down actually does arrive, it may be welcome to allow many companies in the supply chain to catch their collective breath and ramp up for what’s to come. The need for trained machinists, improved production rates, lower costs, and better efficiency has never been more acute. Aerospace manufacturers are responding. Based on our informal survey at the show, several component suppliers said they are expanding their apprenticeship programs. Others are stepping up their games with more accreditations to attract more business. Automation is no longer thought of as a novelty – even smaller tier suppliers are looking to add automated production cells, robotics, multi-axis machines, or inline CMMs to improve productivity so their companies can remain competitive. Are you seeing your business staying steady or increasing, as our contacts at the show reported? If so, how are you responding to meet the goals of a robust aerospace manufacturing market? Please let me know.

|

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

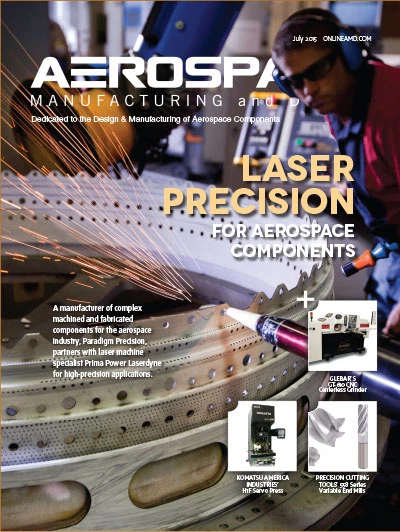

Explore the July 2015 Issue

Check out more from this issue and find your next story to read.

Latest from Aerospace Manufacturing and Design

- Address the challenges of machining high-temperature aerospace components

- Elevate your manufacturing operations with April’s Manufacturing Lunch + Learn

- America Makes announces IMPACT 3.0 Project Call worth $4.5M

- Updated parting and grooving geometries from Sandvik Coromant

- AIX showcases the future of air travel

- Sunnen Products' PGE-6000 gage

- #41 Lunch + Learn Podcast - SMW Autoblok

- Revolutionizing aircraft design without sacrificing sustainability