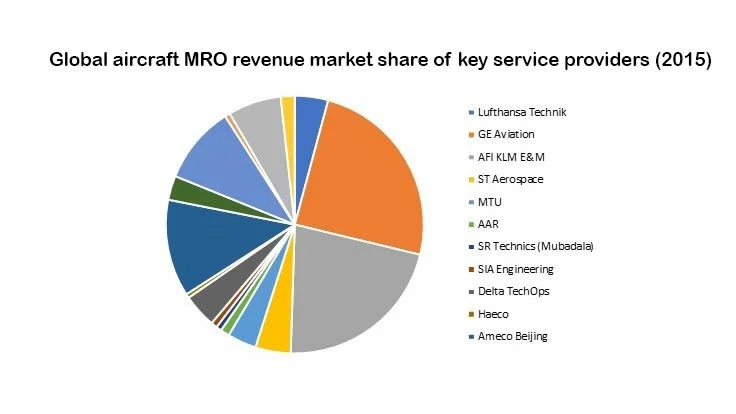

In 2016, the engine segment generated the highest revenue share in the global aircraft MRO market. Among major regions, Asia-Pacific was the highest revenue-generating market, holding nearly 35% of the market share, in 2016.

Esticast Research and Consulting finds, “A surging trend of OEM partnerships is widely being accepted in the engine maintenance segment. Key market players are indulging into partnerships with contractors, local market players, or even military depots, in order to surpass the market fluctuations and hurdles. Moreover, the significantly slow growth in engine MRO compared with that of the global engine fleet has led to the advent of new technology.”

The Business and General Aviation (BGA) segment is expected to grow during the forecast period. The surge in the number of air passengers, all around the globe, is the major determinant driving the growth of this segment. In 2016, the global air transports carried approximately 3.69 billion passengers, as per the data revealed by The World Bank. In terms of region, the Bureau of Transportation Statistics revealed that in 2016 the U.S. airlines carried the highest number of passengers. U.S. airlines carried a total of 823.0 million passengers, out of which 719.0 million were domestic and 103.9 million were international passengers.

The growth of global aircraft MRO market is likely to be hampered by the stringent regulations imposed in this sector. Regulatory rigor is seen in the FAA’s compliance database, which lists about 400 enforcement actions against MRO shops, airlines, and other aviation service providers, in 2015.

Asia Pacific held nearly 35% market share, in terms of revenue, of the global MRO market. The aviation industry in China is growing rapidly with more than 55 airlines that operate across the country. Development of new airports, expansion of existing airports, and expanding domestic fleets is anticipated to drive the MRO market growth in China. In addition, the Korean government is offering a range of financial incentives to MRO companies to enter joint ventures in Korea. The aircraft MRO industry in India is nascent with tremendous opportunities.

Key findings

• The presence of in- house airline MRO, third party airline MRO, OEM- affiliated MRO, and independent MRO is changing the trend by which the MRO services are being provided to customers

• The Middle East commercial aviation MRO market is growing at a faster rate than the global average and most of expenditures are driven by wide body aircraft

• Tax breaks, better MRO infrastructure, cheap labor, and increasing joint ventures in China, have paved the way for new aircraft MRO facilities

• Market players are focusing on joint ventures, mergers and acquisitions, to attain large share of the global market

• Asia Pacific led the global aircraft MRO market in 2016, in terms of revenue, by holding nearly 35% of the total share

Key market players are Lufthansa Technik, GE Aviation, AFI KLM E&M, ST Aerospace, MTU, AAR, SR Technics (Mubadala), SIA Engineering, Delta TechOps, Haeco, Ameco Beijing, Iberia Maintenance, ANA, JAL Engineering, Korean Air, and KAI.

Latest from Aerospace Manufacturing and Design

- Maximize your First Article Inspection efficiency and accuracy

- Archer unveils Midnight Launch Edition

- AMETEK PDS' rapid-response tactical booster amplifiers

- BAE Systems expands Endicott operations to support aircraft electrification

- Frontgrade's Class L GaN DC-DC converter, EMI filter

- #39 - Lunch & Learn Podcast with EMUGE-FRANKEN USA and Okuma America

- Boeing selects Collins Aerospace ejection seats for F-15EX

- Exxelia's mica capacitors